Marital status and spouses year of death if applicable. Why might a wraparound lender provide a wraparound loan at a lower.

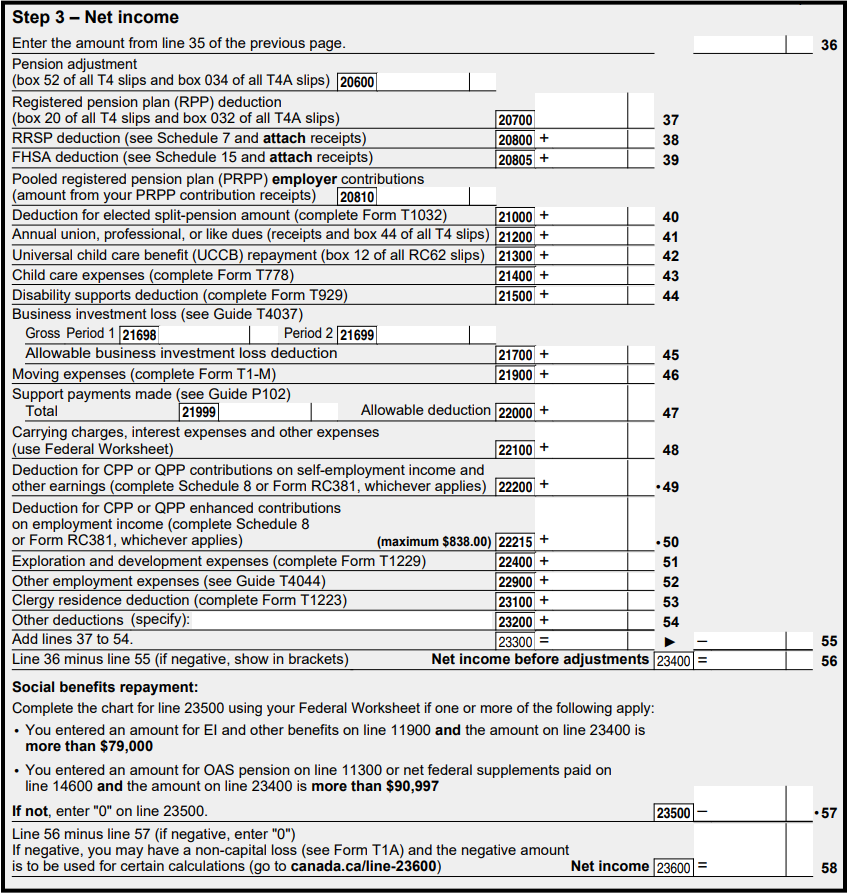

Completing A Basic Tax Return Learn About Your Taxes Canada Ca

Choosing the Right Tax Status Download Article.

. What parts of the tax form are affected by your filing status. Answer to You tind numerous errors in the inventory system that affected net income in prior years. The IRS has rules concerning people who are unmarried.

Check all that apply A single not married 8. Single married filing jointly married filing separately head. The five filing statuses are.

What parts of the tax form are affected by your filing status. Specifically and most importantly- the deductions for AGI and deductions from AGI. So even if you were married on New Years Eve for example tax-wise youre treated as if you were married that entire year.

Your filing status is determined on December 31 of each year. The filing status determines the rate at which income is taxed. If you have recently begun or completed the divorce process your 2021 tax filing status may depend on several factors including the date of your divorce and the terms of the resolution.

Vear 1 is the first vear of the firms operation. Your tax filing status helps the IRS determine your filing requirements standard deduction eligibility for tax credits and correct tax. 13 of the days you were present in the first year before the current year and.

16 of the days you were present in the second year before the current year. Qualifying widow or widower. Married and filing on the same return.

Check your tax brackets. Choose single if you are unmarried. Briefly describe how your filing status is determined.

In this tax tutorial you will learn about filing status. A taxpayer may be able to claim more than one filing status. In each of the following independent situations determine Winstons.

Assume taxes are 40. The five fling statuses are. There are five possible filing status categories.

If more than one filing status applies to you this interview will choose the one that will result in the lowest amount of tax. If total equals 182 days or less Nonresident for Tax. 1The plaintiff files a document a complaint or a petition with the clerk of the court stating the reasons why the plaintiff is suing the defendant and what action the plaintiff wants the court to take.

If your filing status changed in the past year because you got married or divorced or if you expect it to change this year its definitely a good idea to get a sense of how this shift will. All the days you were present in the current year and. The filing status determines the rate at which income is taxed.

This is easily the most impactful mistake that people make when answering the question and for good reason. Married fling separately married and fing different. In most cases your filing status will be one of the following.

Lost spouse and has no dependents C. Step 2 is to be performed only if the individual turns to be a resident. Lets dive into the top 5 mistakes.

Some taxpayers can qualify for more than one filing status. Method 2 Method 2 of 3. You may choose from five different statuses.

There are five filing statuses. Married filing jointly - It may seem strange to file as married when your marriage is. How to Determine Your Filing Status.

Use Windward Report View to determine timely filing limits for the members plan. What parts of the tax form are affected by your filing status. 2The plaintiff must state whether the case is eligible for arbitration according to court rule.

Under United States federal income tax law filing status determines which tax return form an individual will use and is an important factor in computing taxable income. Failing to adapt your response to the employer and role at hand. Briefly describe how your filing status is determined.

If total equals 183 days or more Resident for Tax. What parts of the tax form are affected by your filing status. Single but providing care for a dependent.

Step 1 given below will ascertain whether the individual is resident or non-resident and step 2 will ascertain whether he is ordinarily resident or not ordinarily resident. Your filing status is important as it will be used to decide your tax brackets as well as some limitations on tax deductions and tax credits. If you are not legally married the IRS considers you unmarried.

Filing status is based on marital status and family situation. Your filing status is used to determine your filing requirements standard deduction eligibility for certain credits and your correct tax. Briefly describe how your fing status a determined.

Single individual married person filing jointly or surviving spouse married person filing separately. Usually taxpayers choose the filing status that results in the. Timely filing limit is given in days.

Deciding How to File When Married Download Article. Identify classify and briefly describe the major component deductions on the individual tax return- Form 1040. Briefly describe how your filing status is determined.

Go to the Report Link to the right of the members line of eligibility. The IRS considers this tax filing status to be reserved for unmarried people who have to support others. The question is after all tell me about yourself.

Use good organization visually in particular in devising your list and showing how each of these two categories for and from AGI contribute to arrival at taxable income and. On the Report page scroll down to the General Information section and find the box labeled Timely Filing Limits. Briefly describe how your filing status is determined.

Qualifying widow er with dependent child. What parts of the tax form are affected by your filing status. This tax filing status cannot be used if you are simply the highest earner in your family.

Qualifying widower with dependent child. Head of household. How to Determine Your Tax Filing Status Method 1 Method 1 of 3.

Resume Cv Word Cv Words Resume Words Modern Resume Template

Bus 309 Bus309 Business Ethics Week 9 Quiz 8 Answers Strayer Business Ethics Ethics Job Satisfaction

Completing A Basic Tax Return Learn About Your Taxes Canada Ca

0 Comments